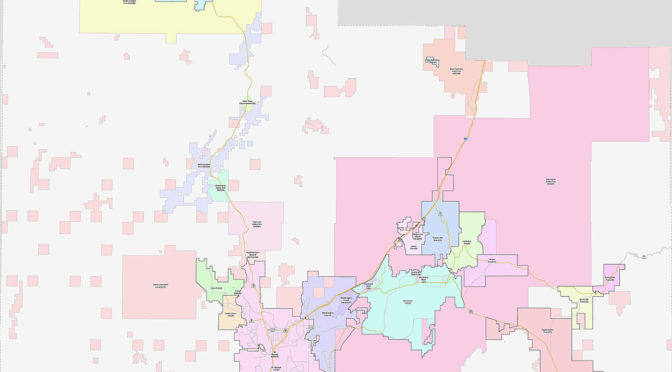

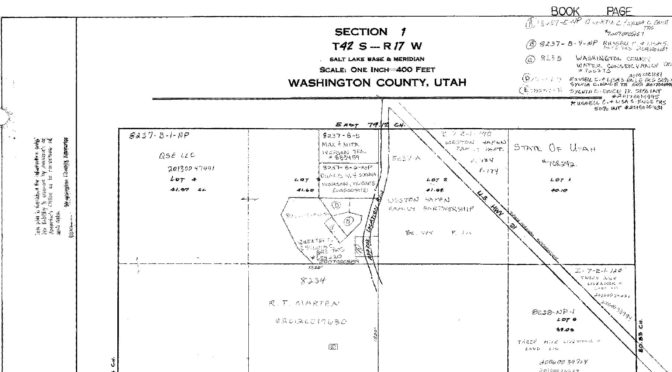

Tech Ridge Community Development Project Area (CDA)

Notice of Interlocal Agreements between the

Redevelopment Agency of the City of St. George and:

City of St. George

Washington County

Washington County School District

Washington County Water Conservancy District

Southwest Mosquitabatement District

In accordance with Sections 11-13-219 and 17C-4-202 of the Utah Code, a notice is provided by the taxing entities listed above, that the Redevelopment Agency of the City of St. George (the “Agency”) entered Interlocal Cooperation Agreements with the

- City of St. George, dated November 9, 2023,

- Washington County, dated November 7, 2023,

- Washington County School District, dated October 30, 2023,

- Washington County Water Conservancy District, dated November 1, 2023, and

- Southwest MosquitAbatement District, dated November 9, 2023

The Interlocal Agreements from all listed taxing entities (the “Participating Taxing Entities”) give authorization to the Agency to receive all or a portion of the Participating Taxing Entities’ tax increment revenues generated within the Tech Ridge Community Development Project Area (the “Tech Ridge CDA”). The funds provided will allow the Agency to carry out the Tech Ridge Community Development CDA Amended Project Area Plan and Amended Project Area Budget. The Participating Taxing Entities listed have agreed to allow the Agency to collect property Tax Increment for a period of (26) years in accordance with the Tech Ridge Community Development Amended Project Area Plan and Amended Project Area Budget.

The Interlocal Agreements are available for public inspection at the Agency’s office located at 175 East 200 North, St. George, Utah 84770 during regular business hours (8:00 am through 5:00 pm), Monday through Friday. Additionally, Interlocal Agreements are available for the public to view at each of the Participating Taxing Entities’ offices during normal business hours (8:00 am through 5:00 pm), Monday through Friday. Addresses of Participating Taxing Entities are provided below.

- City of St. George

- 175 East 200 North, St. George, Utah 84770 (Google Maps)

- Washington County

- 111 East Tabernacle Street, St. George, Utah 84770 (Google Maps)

- Washington County School District

- 121 West Tabernacle Street, St. George, Utah 84770 (Google Maps)

- Washington County Water Conservancy District

- 533 East Waterworks Drive, St. George, Utah 84770 (Google Maps)

- Southwest Mosquit Abatement District

- 1460 South Sandhill Drive, Washington, Utah 84780 (Google Maps)