Property values have increased;

For many, this means property taxes have too.

A Message from Washington County Assessor Tom Durrant:

The 2022 Notice of Property Valuation and Tax Changes has been mailed and will arrive in mailboxes shortly. The notice is not a bill, it is the annual disclosure of tax rates, proposed taxes, appeal dates, and other related information. Recent, drastic changes to property values in Washington County means that most Washington County property taxpayers should expect to see a significant tax increase this year. This information is reflected on the mailed notice.

Utah requires that all property be assessed each year and taxed based on its fair market value, as valued on January 1st of that year. Utah law defines fair market value as the amount at which property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of the relevant facts.

Market activity throughout the 2021 calendar year determines fair market value assessments for the current 2022 tax year. In 2021 we saw unprecedented changes in the value of Washington County real estate, particularly homes. This means the assessed values of property, particularly residential property, have increased to reflect the 2021 market activity.

What does that mean for Washington County property owners? For most, the short answer is to expect a significant tax increase this year.

Utah property tax laws prevent taxing entities (cities, counties, school districts, special service districts, etc.) from collecting more property tax revenue than they collected the previous year. This means tax rates established by the taxing entities should react opposite of the market. So, if the assessed values increase, the tax rate should decrease; if the assessed values decrease, the tax rate should increase; and if the market is stable, the tax rate should also remain stable. This allows for a consistent revenue source for the taxing entities to fund budgets.

To propose an increase to a particular tax rate, the taxing entity must go through a required notification process and conduct a hearing allowing for public comment. Each taxing entity is, however, automatically allowed to collect additional revenue each year from new growth, like new homes.

Some may be wondering: If my property isn’t “new growth” or subject to a proposed tax rate increase why am I paying more tax?

The answer is that individual property taxes can still increase even though a taxing entity is prevented from collecting more tax revenue than they collected the previous year. Simply stated, if an individual property value increase is greater than the average increase, the individual property tax will increase. This individual increase in taxes is called a tax shift.

The increase from a tax shift does not create more tax revenue. Some will pay more, and some will pay less depending on what an individual value did compared to the average value increase. These shifts happen every year for a variety of reasons and can happen on the state level, county level, municipal level, and all the way down to individual property level.

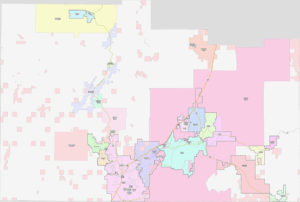

An example of a tax shift occurring this year is when one real estate market area experiences an increase in property values that is more than the increase in another market area. Also, one property type may see an increase in value more than another property type. Utah’s property tax system bases the property tax on the proportional share of the taxable value in the area. Meaning the greater the share of the taxable value, the greater the share of the property tax.

So, when residential property values increase at a higher rate than commercial property values, for example, the residential values may now have a larger proportional share of the tax area and experience a tax shift which will increase individual property taxes.

Other Utah happenings are increasing taxes this year.

In 2018, the Utah State Legislature increased and froze the State School Fund statewide tax rate for five years (2018-2022). Due to increasing market values the tax rate freeze has automatically increased the State School Fund portion of property tax each year. The State School Fund tax increase applies to all taxable property throughout the state. The Statewide Multi-County Assessing/Collecting tax rate is frozen as well.

The mailed property valuation notice includes the 2022 fair market value used for property tax purposes. Each property owner has the right to appeal the market value (not the property tax) with the County Board of Equalization. The Board of Equalization opens August 1 and runs thru September 15. Evidence supporting a change of market value must be included when filing an appeal.

More information can be found at the links below.